According to reports, Blackrock has increased its participation in the Ibit Spot Bitcoin ETF, which takes Holdings to $ 314 million. Why is Blackrock buying Bitcoin? Btcusdt breaks $ 100,000?

A cryptography wave is sweeping the retail and corporate world. Yesterday, New Hampshire become The first state to promulgate Bitcoin reserve. The strategy, formally Microstrategy, is active buying Bitcoin, recently collecting around $ 1 billion of the currency. Meanwhile, institutions accumulate and fight actively for digital gold in May 2025.

Discover: 20+ Next Crypto to explode in 2025

According to reports, Blackrock increases participation in ibit

According to reports, the news that Blackrock, one of the world’s largest asset administrators, is increasing his participation in Ibit, his Spot Bitcoin ETF badge, pushing Holdings to $ 314 million, an increase of 124% from November, is a large amount for cold.

Blackrock increases its position in the ETF of Ishares Bitcoin by 124%, which takes its total holdings to $ 314 million. pic.twitter.com/vv0patsrci

– Trader T (@thepfund) May 6, 2025

This strategic allocation, which probably two or their model portfolios, the allocation of objectives with alternatives and the objective allocation with tax portfolio alternatives, could encourage other companies to follow Suuit.

Just so, Despite the relentless purchase and the “support” of the main players, the price of Bitcoin remains below $ 100,000, strangling the flow of capital to some of the The best ICO to invest in.

A question is big: What does Blackrock know that the rest of us are not? Why are their Bitcoin assignment increasing instead of buying Ethereum or other coins that analysts consider among the best to buy in 2025?

Discover: 11 Best cryptographic pressures to invest in May 2025 – Top Token prevail

Bitcoin’s bet: What does Blackrock know?

The rapid increase in exposure by Blackrock suggests a deliberate strategy. After all, your active search or exposure to BTC through Spot Bitcoin ETFS is not new.

By September 2024, its strategic income opportunities fund (BSIIX) added around 2 million Ibit shares, which raised its total to 2.1 million shares. Meanwhile, the Strategic Global Bond Fund (Mawix) increased its ITIS holdings by 24,000 to 40,682 shares.

In a portfolio presentation today to the SEC, Blackrock revealed to possess 2,140,095 IBIT shares in its portfolio of strategic income opportunities such as September 30, valued at $ 77.3 million.

That is an increase of 88,000 actions previously reported as or June 30.

If you have the leg …

– Macroscope (@macroscope17) November 26, 2024

In a note for investors, Michael Gates, a main portfolio manager for the ETF assignment model portfolio suite, destination assignment, revealed The justification behind his support to Bitcoin, one of the The best crypts to consider buying in 2025.

Gates said they are adding a Bitcoin position, funded from equipment, as an “additional alternative asset,” which points to their fixed supply. The inclusion of the asset in their wallet allows them to diversify risk and performance sources.

In addition, he emphasized that they could Hodl Bitcoin, since it provides “unique and additive sources of diversification” to the portfolios.

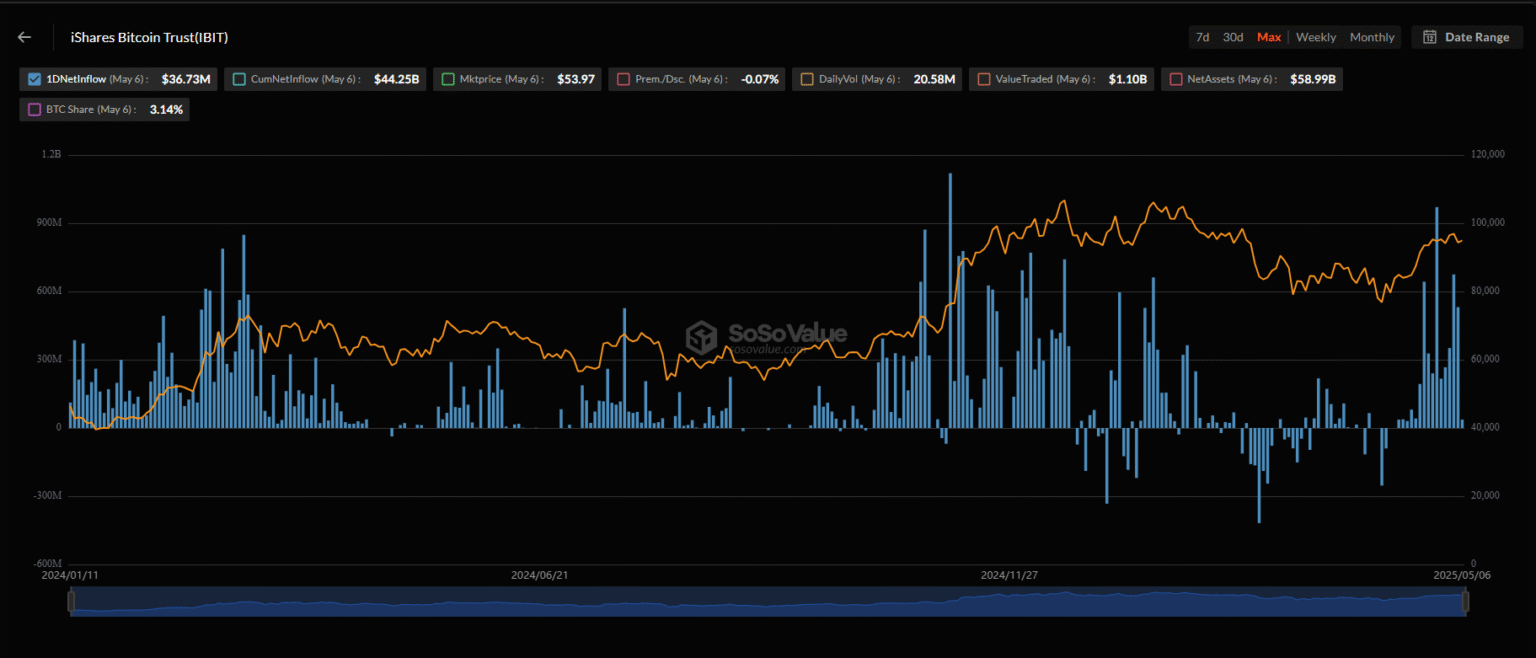

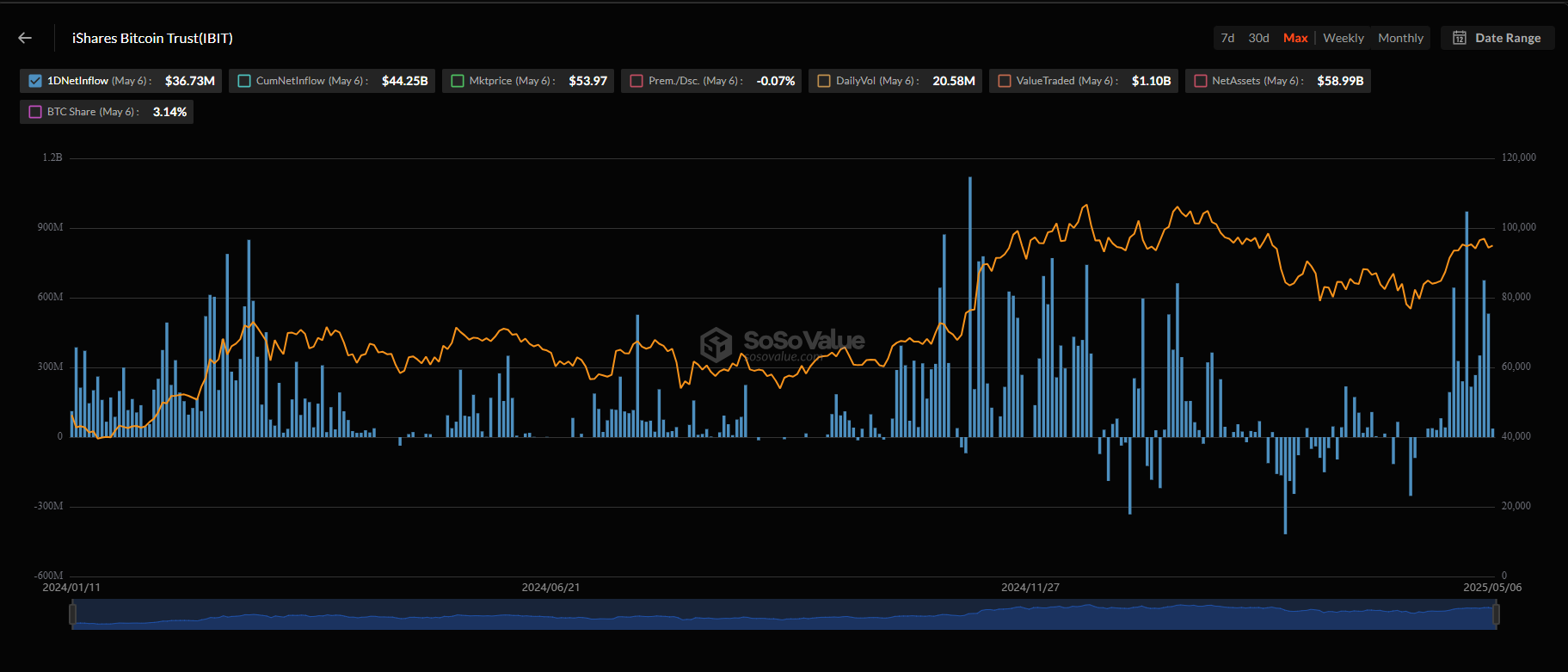

Institutions clearly see the value of maintaining Bitcoin. As of May 2026, Ibit administered More than $ 58 billion of investors who buy Blackrock shares.

(Fountain)

In the last 24 hours, more than $ 36 million were bought in shares. Ibit is among the five ETFs mainly by tickets, drag Only the Vanguard S&P 500 ETF.

Why is the BTCUSDT price stuck?

Despite the constant tickets and the aggressive purchase of the institutions, including the strategy, prices remain below $ 100,000.

Today early, prices recovered up to $ 97,700 before returning to the resistance level.

(BTCUSDT)

In X, an analyst questions the “supply” source that keeps prices low.

He is not allowed to ask where Bitcoin’s “supply” comes from.

BTC cleared $ 100K several times. Now, during the last 2 weeks, it is stuck at $ 94K with M2 exploiting, stocks and gold.$ 4 billion of ETF purchases, $ 1 billion or Saylor purchases.

But you can’t question it.– Whalepanda (@wallepanda) May 6, 2025

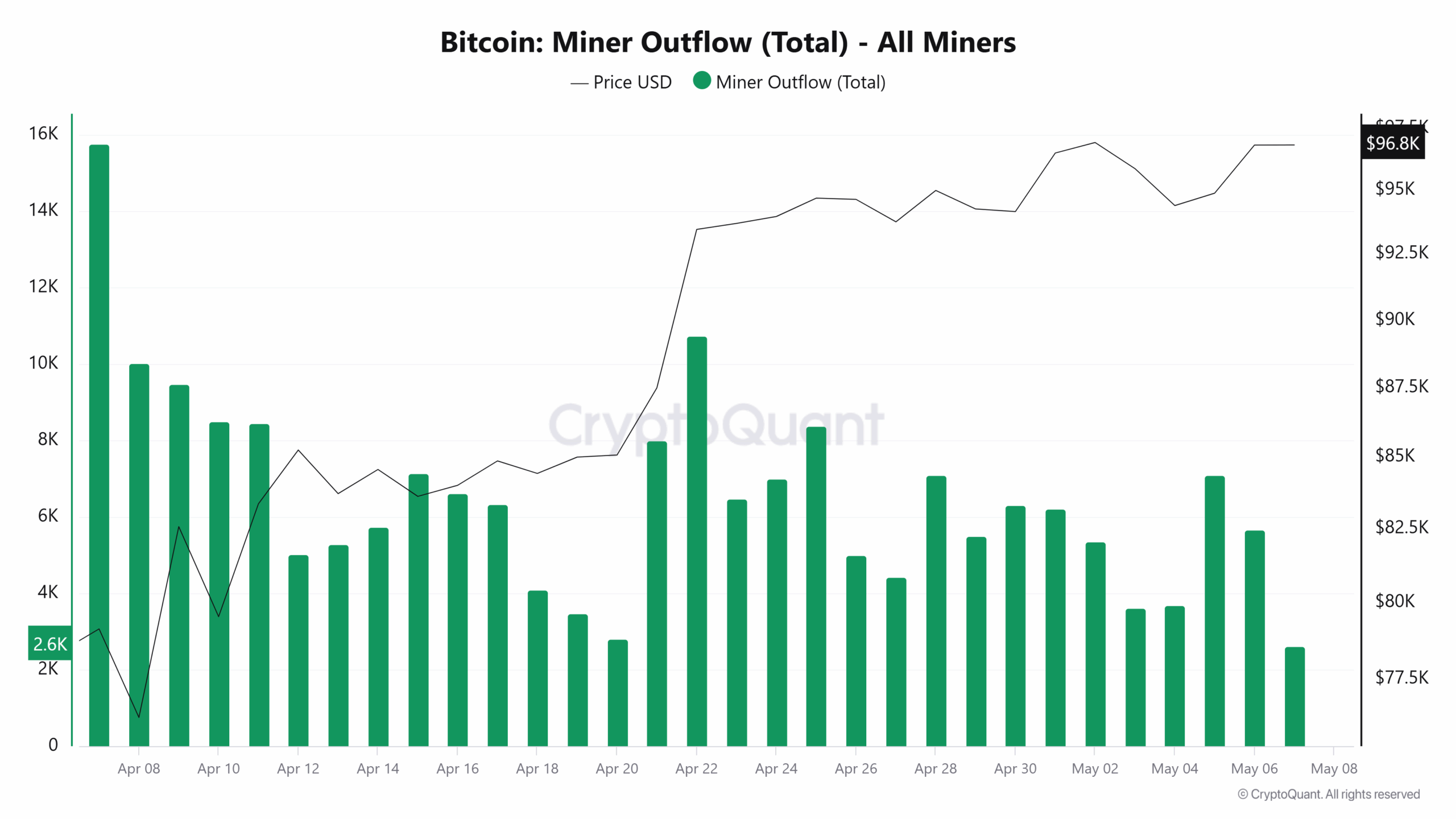

Bitcoin miners, who tend to sell when prices are high, have slowed their liquidation during the last month. According to CryptocharOnly 5,678 BTC They sold May 6, compared to 15,767 BTC soldier April 7.

(Fountain)

With the celebration of miners and the institutions they buy, Bitcoin is likely to break over $ 100,000 in a formation of purchase trends.

Discover: Next 1000X Crypto – 12 coins that could 1000X in 2025

Blackrock increases the Bitcoin ETF stake: Why is the BTC price stuck below $ 100K?

- According to reports, Blackrock has increased its participation in ibit, buying more actions

- The institutions are actively buying Bitcoin, following the forms of the strategy?

- Miners are not selling and Hodl, as cryptocant trends show

- Why does the price of Bitcoin stuck below $ 100,000?

The post Blackrock continues to buy Bitcoin: What do you know not? It appeared first in 99bitcoins.